You can run an art business as a hobby or as a small business (or even a large business).

If it generates any income at all, not necessarily a profit, but receipts or commissions for sales – then you need to keep your business finance separate from you personal finances. That is one of the IRS guidelines that many hobbyists or small business owners seem to put off or totally neglect.

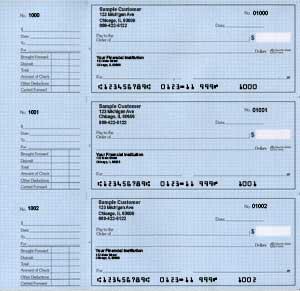

The easiest way to avoid the problem of co-mingled monies is to open a new checking account and use your business checks, especially the register part, to keep track of income and expenses. Simple? Yes, it is. Unless your small business really grows, that may be all you need for your bookkeeping. Be sure to keep track, in the check register, of all money you receive and expenses and keep receipts for expenses paid by cash check or credit card.

Please note that I am not an accountant or a lawyer but I do keep records this way. It has worked well for me and allows my accountant to accurately complete the “Schedule C” for small business when she completes our personal tax return each year.